Analysis of the recent consumption of the European Union and the United Kingdom textile and apparel market

The European Union is one of the important export markets of China's textile industry, China's exports of textiles and clothing to the European Union accounted for the proportion of exports of the whole industry in 2009 reached a peak of 21.6%, the scale of which exceeded that of the United States. Since then, the EU in China's textile and apparel exports accounted for a gradual decline until 2021 by ASEAN beyond the proportion of 2022 has fallen to 14.4%. 2023, China's exports of textile and apparel to the EU continues to reduce the scale, according to China Customs data, January to April China's exports of textile and apparel to the EU 10.7 billion U.S. dollars, a year-on-year decline of 20.5%, the export value of the whole industry accounted for The proportion of exports fell to 11.5 per cent.

The UK, once an important part of the EU market, officially completed its exit from the EU at the end of 2020. After the UK's exit from the EU, the EU's total textile and garment imports shrank by about 15%, and in 2022, China exported a total of $7.63 billion of textiles and garments to the U.K. From January to April 2023, China's exports of textiles and garments to the U.K. amounted to $1.82 billion, a year-on-year decrease of 13.4%.

This year, China's textile industry exports to the EU and UK markets have declined, closely related to its macroeconomic trends and import procurement patterns.

Consumption environment analysis

Several currency rate hikes exacerbated economic weakness, poor personal income growth and unstable consumption base.

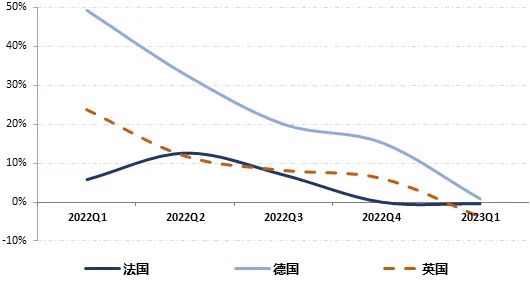

Since 2023, the European Central Bank (ECB) has raised interest rates three times, with the benchmark interest rate increasing from 3% to 3.75%, a significant improvement from the zero interest rate in mid-2022; the Bank of England has also raised interest rates twice this year, with the benchmark interest rate rising to 4.5%, both of which have reached the highest interest rate level since the 2008 international financial crisis. Higher interest rates have increased borrowing costs, constraining the recovery of investment and consumer demand and triggering economic weakness and a subsequent slowdown in personal income growth.2023 In the first quarter, Germany's GDP declined by 0.2 per cent year-on-year, while the UK's and France's GDPs increased by 0.2 per cent and 0.9 per cent year-on-year respectively, with growth rates falling by 4.3, 10.4 and 3.6 percentage points compared with the same period a year earlier. In the first quarter, household disposable income in Germany grew by 4.7 per cent year-on-year, while nominal employee compensation in the UK grew by 5.2 per cent year-on-year, down 4 and 3.7 percentage points from a year earlier, and real purchasing power of households in France declined by 0.4 per cent on a year-on-year basis. In addition, according to a report by the Asda supermarket chain in the UK, 80 per cent of UK households saw their disposable income fall in May, with 40 per cent of UK households falling into a negative income situation, with real incomes insufficient to cover bills and consumption of essential goods.

Influenced by factors such as excess liquidity and supply shortages, European countries have generally faced more serious inflationary pressures since 2022, although the eurozone and the UK have frequently curbed price rises through interest rate hikes since 2022, and the inflation rates in the EU and the UK have recently fallen from a high of more than 10 per cent. in the second half of 2022 to 7 to 9 per cent. but are still much higher than the normal inflation of around 2 per cent. levels. High prices have clearly raised the cost of living and dampened the growth of consumer demand. in the first quarter of 2023, German household final consumption fell by 1% year-on-year, and there was no growth in real household consumer spending in the UK; French household final consumption fell by 0.1% on a year-on-year basis, and the volume of personal consumption excluding price factors fell by 0.6% on a year-on-year basis.

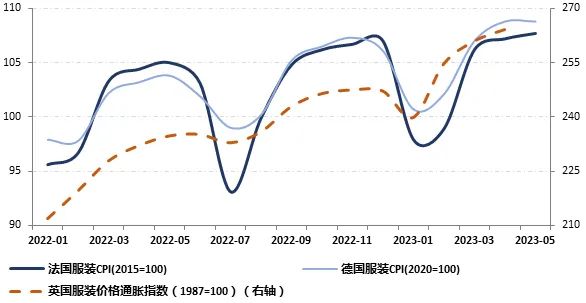

And from the point of view of clothing consumer prices, France, Germany and the United Kingdom not only did not gradually fall with the easing of inflationary pressures, but instead showed a shocking upward trend, in the context of poor growth in household incomes, the inhibition of high prices for apparel consumption is obvious. 2023 quarter, German household consumption expenditure on clothing and footwear increased by 0.9% year-on-year, France, the United Kingdom household consumption expenditure on clothing and footwear fell respectively by 0.4%, 3.8%, the growth rate than the same period last year fell 48.4, 6.2, 27.4 percentage points. 2023 March, France clothing-related products retail sales decreased by 0.1% year-on-year, in April Germany clothing-related products retail sales decreased by 8.7% year-on-year; in the first four months of the United Kingdom clothing-related products retail sales increased by 13.4% year-on-year, the growth rate compared with the same period a year ago slowed down by 45.3 Percentage points, if we exclude the price increase factor, the actual retail sales volume is basically zero growth.

Figure 1: Consumer price growth of clothing in France, Germany and the UK

Analysis of import trends

Currently, the EU's internal trade in textiles and clothing imports have increased, while imports from outside have decreased.

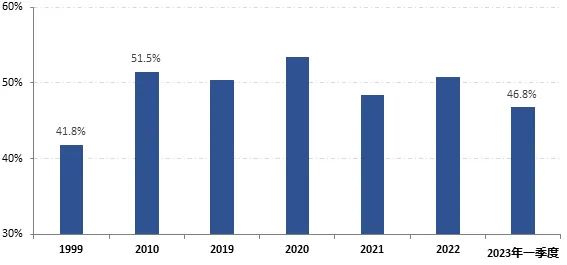

EU textile and apparel products consumption market capacity is large, and due to the EU in the textile and apparel in the gradual reduction of the independent supply, from the external imports is the EU to meet the important way of consumer demand. 1999, from the external imports of EU textile and apparel imports accounted for less than half of the proportion of total imports of textile and apparel is only 41.8%, and since then year by year to improve the proportion of more than 50% in 2010 until 2021 again falling back below 50 per cent. Since 2016, the EU has imported more than $100bn of textiles and clothing from external sources each year, and in 2022 imports amounted to $153.9bn.

Since 2023, the EU's demand for textile and clothing imports from the outside has declined, and internal trade has maintained growth, with a total of 33 billion U.S. dollars of textile and clothing imports from the outside in the first quarter, a year-on-year decrease of 7.9%, the proportion of which declined to 46.8%; the EU's internal trade in textile and clothing imports of 37.5 billion U.S. dollars, a year-on-year increase of 6.9%. Sub-country, in the first quarter, Germany, France from the EU within the textile and clothing imports year-on-year growth of 3.7 per cent, 10.3 per cent, from the EU outside the textile and clothing imports year-on-year reduction of 0.3 per cent, 9.9 per cent.

Britain's imports of textiles and clothing from the EU fell significantly less than imports from outside the EU.

The UK's textile and apparel import trade is dominated by trade to the outside of the EU.In 2022, the UK imported a total of £27.61 billion of textile and apparel, of which imports from the EU accounted for only 32%, and 68% was imported from outside the EU, a slight decrease from the peak of 70.5% in 2010. From the data, Brexit has not had a significant impact on the trade flows of textiles and clothing between the UK and the EU.

From January to April 2023, the UK imported a total of 7.16 billion pounds of textiles and clothing, of which the amount of textiles and clothing imported from the EU decreased by 4.7% year-on-year, the amount of textiles and clothing imported from outside the EU decreased by 14.5% year-on-year, and imports from outside the EU accounted for a year-on-year decline of 3.8 percentage points to 63.5%.

2023-10-27 10:47

- Related News

The importance of battery internal resistance testing in the battery manufacturi

Application and structural principle of high and low temperature test chamber

Application of Small Coating Machine in Polyimide Slurry

Principles and selection methods of laboratory incubators

Evaluation of Moisture Absorption and Rapid Drying Performance of Textiles by Na

Liquid Moisture Management Tester

Paper ring compression strength tester standards