New research: exploring US retailers' sourcing strategies for apparel made from recycled textile materials

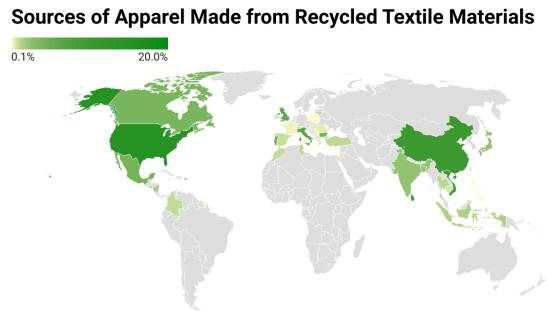

A statistical analysis was conducted using 5,000 randomly selected garments made from recycled textile materials sold in the US retail market between January 2022 and December 2022. The sampled garments came from up to 36 countries, including developed and developing economies in Asia, the Americas, the EU and Africa. The results show that.

First, American retailers purchase clothing made from recycled textile materials from different countries.

However, reflecting the unique supply chain composition of clothing made from recycled textile materials, American retailers purchase such products in a very different way from conventional new clothing. For example, by 2022, the vast majority (that is, more than 90%) of conventional new clothing in the USA will come from developing countries (UNCommtrade, 2022), and as many as 43% of the sampled clothing will be made of recycled textile materials (n=1408) from developed countries. Similarly, when purchasing clothing made of recycled materials, American retailers seem to rely less on Asia (41.9%, n=1387), but more frequently use close sourcing from the USA (30.1%, n=994), especially domestic sourcing from the USA (14.8%, n=490).

Secondly, when purchasing clothing made of recycled textile materials, American retailers seem to have set a differentiated classification for products imported from developed and developing countries.

Among sampled garments made from recycled textile materials, imports from developing countries were on average more varied than those from developed economies. Similarly, imports from developing countries are also concentrated in products that are relatively complex to manufacture compared with developed countries. The wider apparel production capabilities in developing countries than in developed economies, including available production facilities and skilled labor, may have contributed to this pattern.

Possibly due to the higher overall production costs in developed countries, the average retail price of sampled garments purchased from developed countries is significantly higher than that in developing countries. However, there is no clear evidence that U.S. retailers primarily use developed countries as a sourcing base for luxury or premium goods, while only targeting developing countries for mass or value-market goods.

Specifically, imports from Asia are the most diverse (eg, sizing options) and focus on complex product categories (eg, outerwear) for mass and value markets.

Imports from the Americas (North, South, and Central America) are concentrated in simple product categories (such as T-shirts and socks) with moderate assortment diversity and are primarily aimed at mass and value markets.

The imports from the EU are mainly higher-priced luxury goods, belonging to the middle and high-end or high-end product categories, with a wide variety.

Imports from Africa are mainly concentrated in relatively high-quality or luxury goods with simple product categories (i.e. swimming trunks) and limited varieties.

The findings of the study demystify the country of origin of garments made from recycled textile materials hidden behind macro trade statistics. The findings also create important new knowledge about the supply chain for apparel made from recycled textile materials and the unique sourcing patterns of U.S. retailers and factors that influence such products. These findings have several other important implications:

Firstly, the results of the study reveal a broad supply base for garments made from recycled textile materials and offer promising sourcing opportunities for such products. While existing research suggests that consumers are increasingly interested in purchasing garments made from recycled textile materials, the results of the study show that this 'enthusiasm' also applies to the supply side, with many countries already manufacturing and exporting such products. At the same time, the results show that US retailers are sourcing garments made from recycled textile materials in a wide range of products and prices, targeting different segments of the market to meet different consumer needs. In addition, as advances in textile recycling technology continue to enrich the product offerings of apparel made from recycled textile materials, the sourcing demand and supply base for such products by US retailers is likely to expand further.

Second, the findings suggest that sourcing apparel made from recycled textile materials may help U.S. retailers realize business benefits beyond positive environmental impact. For example, China appears to play a less dominant role as a supplier of apparel made from recycled textile materials to U.S. retailers, given its unique supply chain makeup and production requirements. Instead, a significant portion of such products are "Made in America" or sourced from the USA (eg, El Salvador, Nicaragua) and emerging African destinations (eg, Tunisia and Morocco). In other words, sourcing apparel made from recycled textile materials can help U.S. retailers achieve several goals they have been working toward, such as reducing reliance on sourcing from China, expanding proximity, and diversifying their sourcing base.

In addition, the findings of the study call for strengthening the domestic clothing manufacturing capacity in the USA to better meet retailers' demand for clothing made of recycled textile materials. On the one hand, the results show that American retailers have a strong interest in purchasing clothing made of recycled textile materials "made in the USA". In addition, the USA may enjoy some competitive advantages in manufacturing such products, from the rich supply of recycled textile wastes and the affordability of expensive modern recycling machinery to advanced research and product development capabilities. On the other hand, the results show that American retailers mainly purchase simple product categories (such as T-shirts and socks), targeting the value and mass market of the USA and other American countries. This mode reflects the production and procurement mode of conventional new clothing to some extent. Compared with Asian and European suppliers, "Made in America" clothing also lacks product categories and focuses on basic fashion items. Therefore, strengthening the domestic clothing production capacity of the USA, especially those complex product categories (such as coats and suits), can encourage more procurement of "Made in America" clothing using recycled textile materials, and support the clothing production and job creation manufacturing industry in the USA.

2022-12-30 10:50

- Related News

The importance of battery internal resistance testing in the battery manufacturi

Application and structural principle of high and low temperature test chamber

Application of Small Coating Machine in Polyimide Slurry

Principles and selection methods of laboratory incubators

Evaluation of Moisture Absorption and Rapid Drying Performance of Textiles by Na

Liquid Moisture Management Tester

Paper ring compression strength tester standards